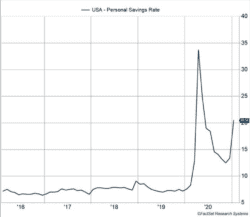

The impact of government stimulus checks continues to permeate economic data. Personal income rose 10% in January, and disposable income rose 11.4%. Where did the money go? It primarily bought goods or was saved. Goods spending rose 5.8% in January, and the personal savings rate jumped to 20.5% from 13.4% the previous month (Figure 1). Limits on activity continue to pressure services spending, which rose only 0.7%.

Key Points for the Week

- Government stimulus payments drove personal income 10% higher in January.

- Economic growth estimates are rising on expectations for vaccine distribution and an additional stimulus package.

- Interest rates have increased based on expectations for faster economic growth.

Investors are raising their expectations for economic growth and inflation because of the additional stimulus. Several economists have pushed growth expectations to more than 6% this year, and inflation expectations have moved above 2%. Actual inflation data remains weak, and the PCE price index rose only 1.5% over the last year.

The increasing growth expectations have contributed to rising interest rates. When rates rise, it often pressures the returns of stocks as well as bonds. Last week, the S&P 500 dropped 2.4% in response to economic data. The MSCI ACWI index sagged 3.3%. The Bloomberg BarCap Aggregate Bond Index fell 1.5% last week.

The U.S. employment situation will top economic reports next week. The primary focus will be on whether the service economy shows signs of strength based on mid-February survey data.

Figure 1

Looking Forward to More Growth

After a difficult and trying 2020, in which the U.S. economy contracted 3.5%, investors are looking forward to the prospect of growth. An environment of rising yields, inflation concerns, stock market highs, COVID uncertainty, government stimulus packages, accommodative monetary policy, and massive vaccine rollouts makes it even more difficult to confidently predict the future.

Let’s start with the most recent data. Personal income was up 10% in January, but the increase was almost entirely attributable to the $600 government relief checks and unemployment insurance payments. Consumer spending was also up 2.4% last month, marking the biggest increase since last June. This gives credence to the jump in retail sales numbers released last week as consumers are evidently spending the money quickly. The personal consumption expenditures (PCE) price index, excluding the volatile food and energy component, the Fed’s preferred inflation gauge, rose 0.3% after a similar gain in December. This shows even with the increased spending, inflation currently remains benign.

The next stimulus package is moving forward through Congress, and economists are increasing their U.S. GDP estimates for the year to 6-6.8% growth. To put the stimulus’s potential effect in perspective, the Federal Reserve previously forecasted real GDP growth of 4.2% in 2021.

It’s important to note that even with the potential increased spending from more stimulus and the release of pent-up demand as the country reopens in the second half of the year, the Fed is currently not worried about inflation. It views any inflation uptick as transitory and has stated it will remain accommodative until labor markets improve in terms of lower unemployment rates and increased labor participation.

Meanwhile, the optimism about economic growth contributed to further increases in interest rates. The closely watched 10-year Treasury temporarily reached 1.5%, which is near the dividend yield of the S&P 500. If stock values are created using projected future cash flows, the value of these future cash flows declines when rates are rising. Rising yields often hit stocks with higher dividends hardest as their yields need to compensate investors for the additional risk and tougher competition from bonds.

2021 is shaping up to be much better than 2020, but numerous unknowns remain. Virus infection rates have dropped and levelled off, but there are potential new variant threats. The vaccine rollout is increasing as more vaccines are manufactured and approved, but we have yet to see how many people will forego a shot when it’s readily available. Spending is improving, but labor markets are still weak. Inflation is subdued but has the potential to pick up. To quote Dr. Anthony Fauci, investors have the right to be “cautiously optimistic.”

—

This newsletter was written and produced by CWM, LLC. Content in this material is for general information only and not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly. The views stated in this letter are not necessarily the opinion of any other named entity and should not be construed directly or indirectly as an offer to buy or sell any securities mentioned herein. Due to volatility within the markets mentioned, opinions are subject to change without notice. Information is based on sources believed to be reliable; however, their accuracy or completeness cannot be guaranteed. Past performance does not guarantee future results.

S&P 500 INDEX

The Standard & Poor’s 500 Index is a capitalization-weighted index of 500 stocks designed to measure performance of the broad domestic economy through changes in the aggregate market value of 500 stocks representing all major industries.

MSCI ACWI INDEX

The MSCI ACWI captures large- and mid-cap representation across 23 developed markets (DM) and 23 emerging markets (EM) countries*. With 2,480 constituents, the index covers approximately 85% of the global investable equity opportunity set.

Bloomberg U.S. Aggregate Bond Index

The Bloomberg U.S. Aggregate Bond Index is an index of the U.S. investment-grade fixed-rate bond market, including both government and corporate bonds

https://fred.stlouisfed.org/series/T5YIE

Compliance Case #00966583